$1.3+ Billion in Bids Created

Stop Guessing.

Start Profiting.

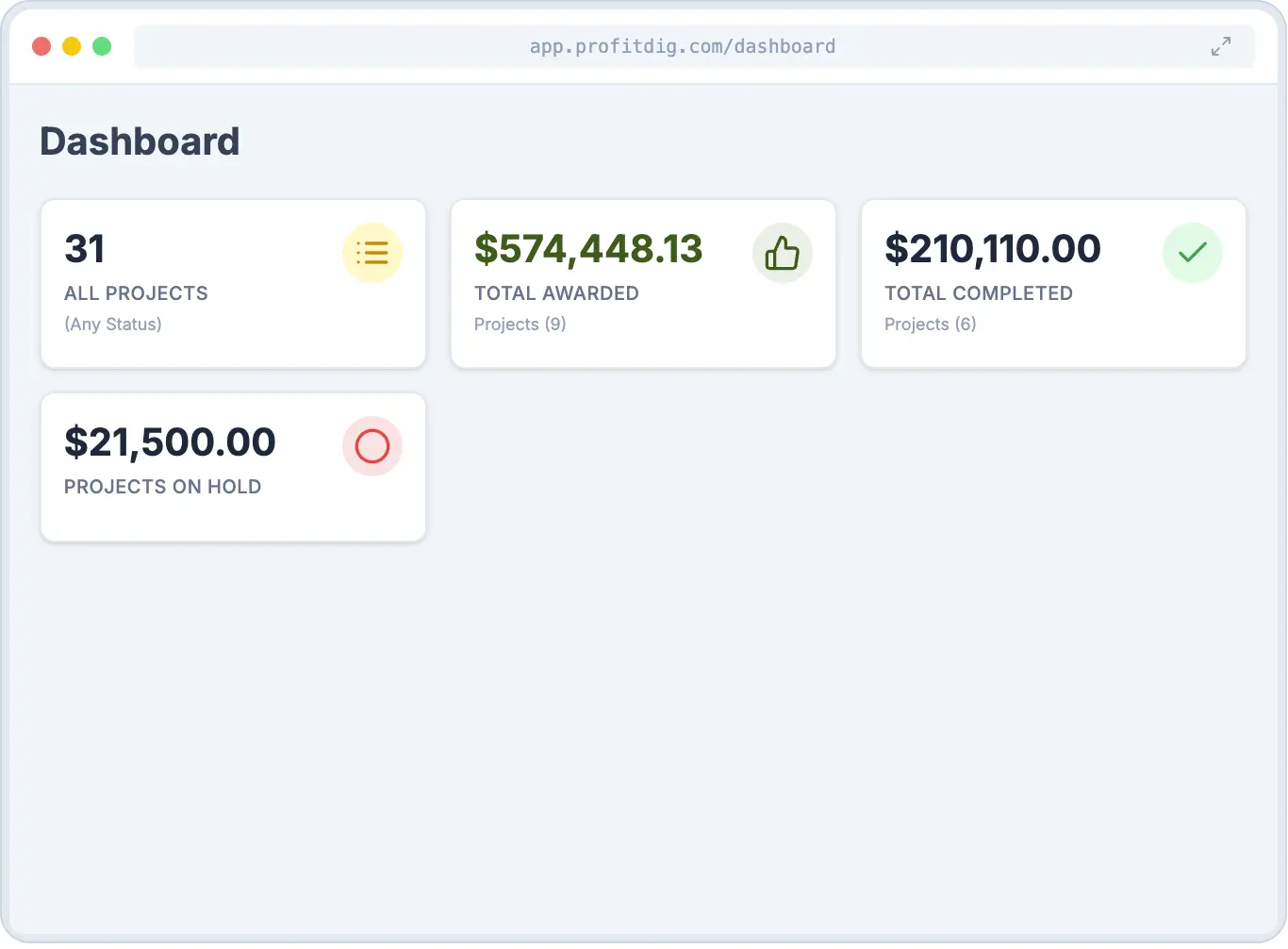

The easiest way for construction contractors to bid jobs in minutes, track costs in real-time, and eliminate the unknown.

30-Day Money Back Guarantee• Cancel anytime

Manage your bid items faster.

Create, organize, and reuse your bid items and headers. Build a master database that speeds up every future proposal you create.

- Standardize your bidding language

- Quickly search and insert items

- Eliminate repetitive manual entry

Bid Items & Headers

ID

Name

1001

Erosion Control

2000

DOT

2001

Grading

3001

Storm Drainage

4001

Domestic Water Line

5001

Sanitary Sewer

6001

Fire Water

7001

Electrical

8001

Demolition

Showing 9 items

| Identifier | Quantity | Unit | Total | ||

|---|---|---|---|---|---|

| B Underground | $20,646.34 | ||||

| LI Standard Silt Fence | 1200 | [LF] | $4,839.08 | ||

Bid in minutes, not hours.

Stop reinventing the wheel for every proposal. Clone previous successful bids, use your saved item database, and generate professional PDFs instantly.

- Instant markup calculations

- One-click PDF generation

Don't take our word for it.

DG Construction Inc.

"Since I’ve been using ProfitDig, my margins have increased and I have been making more money. It just works for me. It’s simplistic. I have used other estimating platforms in the past and ProfitDig is just better."

Dylan Gandy

Owner

Simple, transparent pricing

No hidden fees. No long-term contracts. Cancel anytime.

Solo

$149/mo

Start Risk-Free- 1 User

- Unlimited Projects

- Profit & Loss Reporting

- Project Notes & File Storage

Most Popular

Team

$199/mo

Start Risk-Free- 3 Users

- Unlimited Projects

- Profit & Loss Reporting

- Project Notes & File Storage

Business

$299/mo

Start Risk-Free- 10 Users

- Unlimited Projects

- Profit & Loss Reporting

- Project Notes & File Storage

- Onboarding Assistance

Frequently Asked Questions

Is there really no contract?

Absolutely. You pay month-to-month and can cancel at any time. We believe our product should earn your business every month.

How does the money back guarantee work?

If you aren't satisfied within the first 30 days, simply email us and we will refund your first month's payment in full. No questions asked.

Is my data secure?

Yes. We use bank-level 256-bit encryption to protect your data. Your information is backed up daily and stored on secure servers.

Does ProfitDig work on Mac and Mobile?

Yes! ProfitDig is 100% cloud-based, meaning it works on any device with a web browser, including iPads, Android tablets, Macs, and Windows PCs.

Is there a limit on projects?

No. You can bid and manage an unlimited number of projects. We don't believe in penalizing you for growing your business.